Look at the debt.

This is the step I avoided for a long time. It’s hard to face your demons, so I’m going to put them center stage for all to see. It’s embarrassing, but kind of relieving to see it all in one place like this.

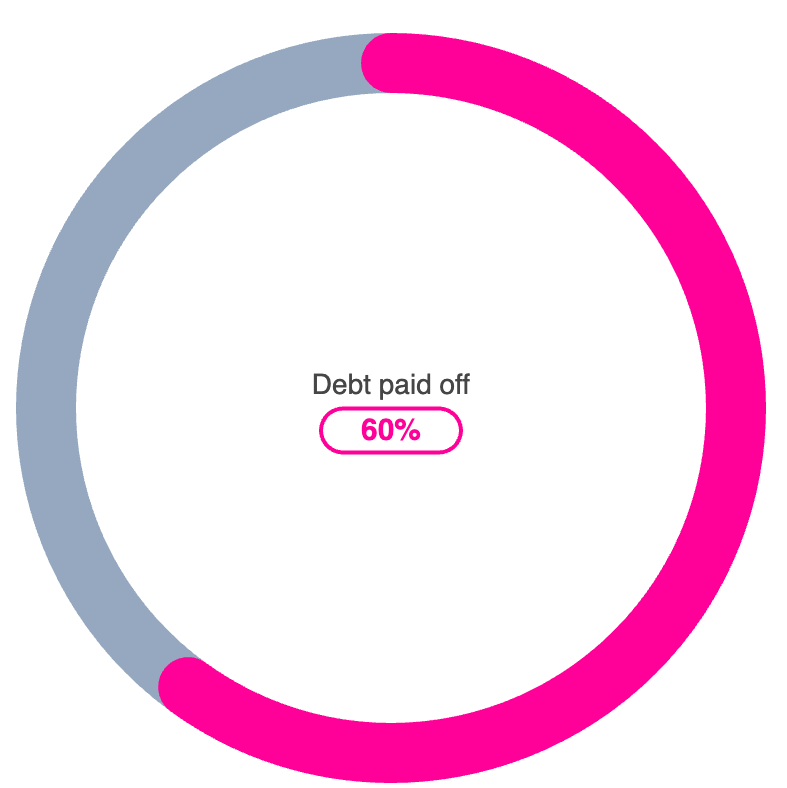

My debt payment progress.

$28,342/$70,423

Here is a breakdown of all of my debt.

Priority Debt

Backtaxes ’23

2023 income taxes.

Promised to pay by April 2025

7.00% APR

Back Taxes

-$5,493.35

Starting: -$5,077.00

1/1

AmEx

Opened July 2019. My first big credit limit. ($2,000 originally)

28.99% APR

Min. Payment: $97

Credit Card

-$3,384.94

Credit Limit: $3,500

112

Dad’s Loan

Received in 2022. The debt that I have the most guilt over.

6.00% APR

Payment: $200

Personal Loan

-$3,600.00

PAUSED – JAN 2026

112

NelNet

Opened January 2018. I am so fortunate to have had my parents pay for my schooling.

4.45% APR

Min. Payment: $50

Student Loan

-$4,518.64

PAUSED – MAY 2025

112

Upgrade

Needed funding after getting laid off.

4.45% APR

Min. Payment: $50

Personal Loan

-$7,985.00

Starting: $8,000.00

2/2

Paid Off

CarMax

Car Loan

$0.00

Starting: -$11,863

1

Upgrade

Personal Loan

$0.00

Starting: -$10,000

1/2

Chase

Credit Card

$0.00

Credit Limit: -$5,800

1/2

Credit One

Opened September 2022. It’s unclear why I was approved.

28.99% APR

Min. Payment: $97

Credit Card

$0.00

Credit Limit: $3,000

1/2

Uplift

Cruise Loan

$0.00

Starting: -$2,676.00

1/1

Apple Card

Credit Card

$0.00

Credit Limit: $1,750

1/1

Affirm

A special gift for a special person.

26.99% APR

Christmas Loan

$0.00

Starting: -$1,629.14

3/3

Backtaxes ’22

Back Taxes

$0.00

Starting: -$1,311.12

1/1

Medical Debt

One medical emergency later…

Payment: $53

Personal Loan

$0.00

Starting: -$671.87

112

Ameris

Opened May 2023. Trying to get 0% interest cards.

0% APR until Sept. 2025

Credit Card

$0.00

Credit Limit: -$600

1/1

Affirm

Personal Loan

$0.00

Starting: -$562.69

2/3

Chase

Opened May 2023. Trying to get 0% interest cards

0% APR until Sept. 2025

Credit Card

$0.00

Credit Limit: $550

2/2

Credit One

Credit Card

$0.00

Credit Limit: $550

2/2

Capital One

Credit Card

$0.00

Credit Limit: $300

1/1

Affirm

$0.00

Starting: -$185

1/3

last updated: March 6, 2024

My Total Debt.

-$28,342.58

Original Debt: -$70,423.66

Min. Monthly Payments.

$600.00

35% of monthly net income

It quickly got out-of-hand.

New phones, nice restaurants, helping friends and vacations. I just wanted to list a few reasons why I am in this position. Over time, its really easy to lose track of what your tab has amounted to. Your monthly payments start to blur together until all you see is an entire paycheck gone after bills.

Most was non-essentials.

The vast majority of my debt isn’t from noble sources like student loans, or medical debt. I wanted to spend money on things I could not afford. Now I spend more on minimum payments than I do on all of my other bills (including rent) combined.